COFI is only reason we have not seen a major crash

The 11th District Cost of Funds index (COFI) is one of the most popular ARM indexes. This index is primarily used for ARMs with monthly interest rate adjustments. Because this index generally reacts slowly in fluctuating markets, adjustments in your ARM interest rate will lag behind another market indicators. Many lenders believe COFI-indexed ARMs are some of the best deals available on the market today. The 11th District COFI is a 2-month lagging index: the index value for a particular month is not reported until the end of the next month.

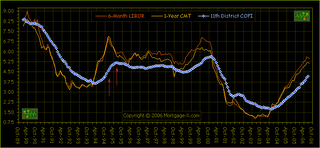

From the graph it is quite obvious that the COFI is under performing at 4.2% which combined with a 1-2% margin will save alot of folks from foreclosure however, it is trending up as soon as it gets over 5.5-6% the major crash will commence.

The chart below compares other indices with the COFI, what a huge difference in rates and in my estimation enough difference to cause this "house of cards" to fall over.

7 comments:

hey, can you make the blog work on macs?

It doesn't work on FireFox (Windows nor Mac) either.

I am checking into it.

http://www.housejockey.com/blog/

http://www.housejockey.com/blog/

http://www.housejockey.com/blog/

http://www.housejockey.com/blog/

http://www.housejockey.com/blog/

http://www.housejockey.com/blog/http://www.housejockey.com/blog/

http://www.housejockey.com/blog/

http://www.housejockey.com/blog/

!!@!!!!!!!!11!!!1!!one!!!

hey now the site works!

Cheap and trendy deisgner clothing from http://www.ronkaclothing.com where we sell: Modern Vintage Shoes, A.L.C., Flats, Kain Label, Gara Danielle, Freelook, Balmain, Apparel, Myne, Low Luv x Erin Wasson, Leigh & Luca New York, Rock & Republic, Thatcher by Alisse Thatcher - all available from our online designer clothing store at 50% off sale!

Post a Comment